Why Homeownership Wins in the Long Run

Today’s higher mortgage rates, inflationary pressures, and concerns about a potential recession have some people questioning: should I still buy a home this year? While it’s true this year has unique challenges for homebuyers, it’s important to think about the long-term benefits of homeownership when making your decision.

Consider this: if you know people who bought a home 5, 10, or even 30 years ago, you’re probably going to have a hard time finding someone who regrets their decision. Why is that? The reason is tied to how home values grow with time and how, by extension, that grows your own wealth. That may be why, in a recent Fannie Mae survey, 70% of respondents say they believe buying a home is a safe investment.

Here’s a look at how just the home price appreciation piece can really add up over the years.

Home Price Growth over Time

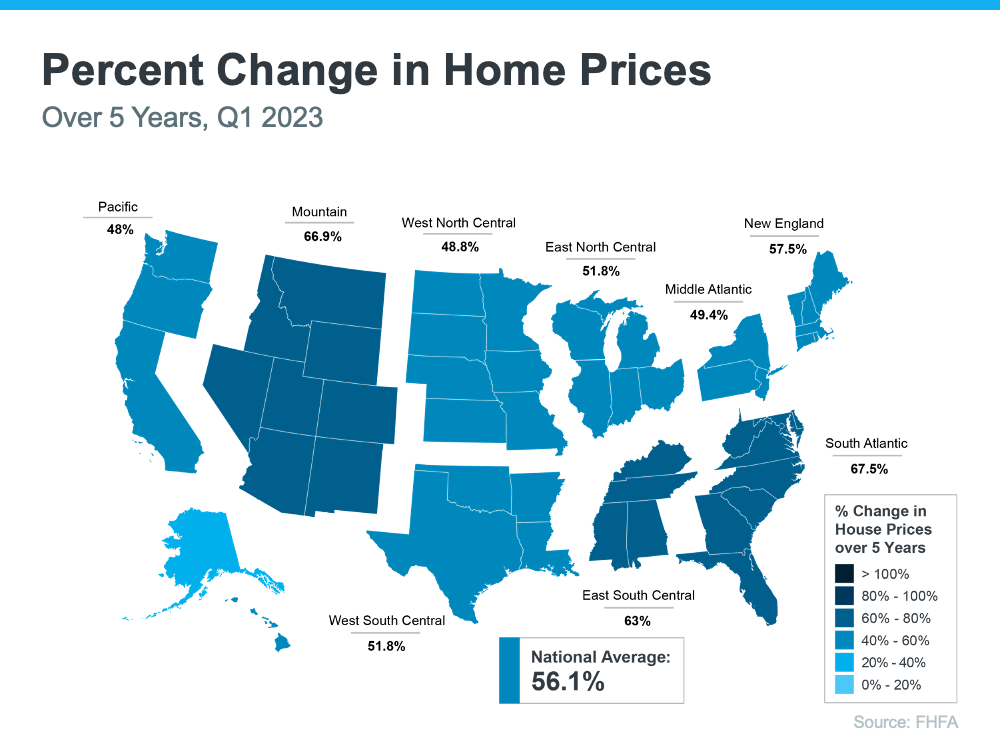

The map below uses data from the Federal Housing Finance Agency (FHFA) to show just how noteworthy price gains have been over the last five years. And, since home prices vary by area, the map is broken out regionally to help convey larger market trends.

If you look at the percent change in home prices, you can see home prices grew on average by just over 56% nationwide over a five-year period.

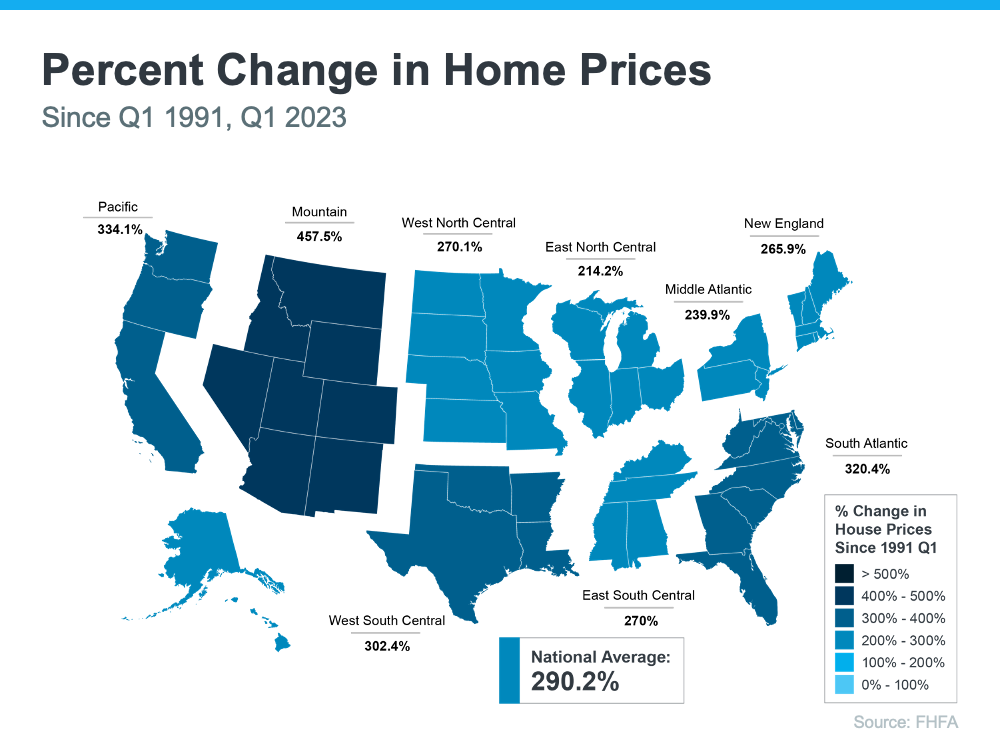

Some regions are slightly above or below that average, but overall, home prices gained solid ground in a short time. And if you expand that time frame even more, the benefit of homeownership and the drastic gains homeowners made over the years become even clearer (see map below):

The second map shows, nationwide, home prices appreciated by an average of over 290% over a roughly 30-year span.

This nationwide average tells you the typical homeowner who bought a house 30 years ago saw their home almost triple in value over that time. That’s a key factor in why so many homeowners who bought their homes years ago are still happy with their decision.

And while you may have heard talk in late 2022 that home prices would crash, it didn’t happen. Even though home prices have moderated from the record peak we saw during the ‘unicorn’ years, prices are already rebounding in many areas today. That means, in most markets, your home should grow in value over the next year.

The alternative to buying a home is renting, and rental prices have been climbing for decades. So why rent and deal with annual lease hikes for no long-term financial benefit? Instead, consider buying a home.

Bottom Line

If you’re questioning if it still makes sense to buy a home today, remember the incredible long-term benefits of homeownership. If you’re ready to start the conversation, let’s connect today.

Bottom Line

Remember, a 20% down payment isn’t always required. If you want to purchase a home this year, give us a call at 509-703-8187 or fill out the form below to start the conversation about your home buying goals.

Check out our latest blogs for more real estate tips and news!

- Saving for a Down Payment? Here’s What You Need To Know.

- Why the Median Home Price Is Meaningless in Today’s Market

- A Drop in Equity Doesn’t Mean Low Equity

Join The Discussion